Do you need to fill in a Australian BAS or New Zealand GST using Sage 50? How about Cyprus TAXISnet or German MwSt? Or could it be French TVA, Italian IVA, Indian VAT or Canadian GST and when using Sage 50 Accounts it’s giving you a headache?

This unique program will allow Sage 50 & 50cloud Accounts to be adapted to work in any of the 70+ regions of the world that operate a Value Added Taxation system.

Core Features of Adept Sage 50 Tax Add-On

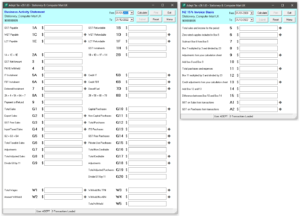

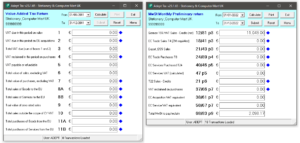

- Tax Form editor allows Tax Forms to be configured for any VAT regime.

- Can handle multiple Tax Forms.

- Multi Region, Distance Selling & Special Scheme VAT returns.

- Library of pre-designed Tax Forms and Reports that can be downloaded and installed automatically.

- The original Library of pre-designed Tax Forms were for Australia & New Zealand.

- The latest additions to the Library of pre-designed Tax Forms are for Cyprus & Germany.

- Drill down to the individual transactions that have been used for a return.

- Automatic drillable archives are created when a form is submitted.

- Forms and Reports are generated in HTML format for maximum flexibility.

- Built in email facility allows any form or report to be emailed at the press of a button.

- Tax Reference Format editor allows the formats for any country to be edited.

- Fully integrated with the Sage 50 Audit Trail VAT Reconciliation flag.

- The Tax Form Editor can be disabled if the program is to be used by unskilled staff.

- You do not have to log other users out of Sage while using this Add-On Tool.

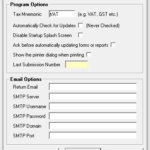

- The program can be run from a button on the Sage Transactions or VAT module.

Add-On Pricing and Compatibility

- Only £180.00 + VAT for a company wide licence plus 20% Annual Renewal Fees.

- Adept Add-Ons are Multi User at no extra cost.

- Compatible with the UK Edition of Sage 50 & 50cloud versions 8 to 30.

- Unless otherwise stated, also works with any minor version numbers such as v28.1 or v29.2

- Adept Add-Ons are backwards compatible when it comes to Sage versions, most go back to v8

- Web Update facility to keep your program up to date, accessed via Menu>About.

- Thirty day Free Trial available.

Customer Testimonials for Adept Tools & Support

Your Back to Back Ordering Tool is one we use numerous times a day, so thanks for the great software.

Thanks for the add-ons you created. I’ve used Sage for about 25 years and your input has been invaluable.

The instructions you gave worked perfectly, after giving normal users permission they can use ADEPT just fine, so many thanks for that.

I cannot sing the praises of Adept loudly enough!

That explains it!!! Thank you so much I really appreciate it! Thanks & regards.

Thanks for getting back, happy with your proposal, we have greatly appreciated your support over the past few years and would rather put the business your direction.

Thanks Danny, I am very impressed by the quick turnaround of my queries. Thanks & Regards.

Most kind! Thanks, Danny.. Even on a Sunday(!)

Many thanks for this update and assistance Danny with the Mess Subs Add-On.

We have now moved away from Sage 50 (outgrown it!) but it was a great product and your service has been awesome.

Thank you very much. It was lovely to see the tool picking up the new licence info without any intervention by us – if only all software was so user-friendly.

Once again, Danny you have been terrific and a pleasure to work with. Thanks.

A quick note to say thanks for this. We have successfully implemented your product using the Trial License versions supplied to us. Our customer is happy with the results and will be in contact over the next couple of months to purchase the products.

Thank you again for your help on this, I was really stuck earlier. I understand the Sage RDA Service can be a temperamental beast. I was in awe of your keyboard skills too!

Great job btw Danny. Adept contact will not be forgotten!

Thanks a lot, Danny, as ever for such great service. If you ever have anyone wondering about using this add-on just tell them to phone me.

Thanks for your help. We have the new version and with a bit of a workaround it will now do what we need. That was great customer support. Regards.

Thank you very much – worked like a dream! Many thanks, I will definitely come to you next time I have a problem.

Thanks for clarifying Danny. I appreciate the speedy resolution on renewing the Adept licences this morning.

This now works brilliantly thanks, I will be purchasing a licence shortly. Great support too Danny, cheers.

Love the B2B tool BTW, Sage would be useless for us without it!

Great news! All seems to be working, thanks very much for all your help – high five!

Thanks again for the fantastic support, please feel free to put that on your website. Kind regards.

Thank you for our SOP template, it is working excellently here.

Thanks for the Stock Transaction editor upgrade. We have the Sage Line 50 Code Changer software too, Both bits of software have been absolutely invaluable over the years!

Just to let you know that we upgraded to Sage 50c Accounts Professional v25 yesterday. Although the Sage update was not eventless, the upgrade of our Adept Tools was straightforward. Thank you.

You were on the button. I removed all users. Adept was stuck in there plus one other user. After removing those and restarting Adept, it found the import file and imported it. Thanks for your top notch support.

Thanks again for your help. And congratulations on creating some fantastic tools! Kind regards.

Many thanks Team, superb..!!

I’ve got several of your Sage tools and think they are fab! Thank you.

Thanks for sending Adept the lovely hamper, too kind! – Not at all – you help is much appreciated. We use your systems daily and they have been a great help to our business.

Thank you for explaining the versions and that we need Sage Standard and not the Pro she was trying to make to buy at gunpoint!

Other customers also purchased these tools

Adept Sage 50 CSV Import Tools for Sage 50 Accounts

For more reviews about the Adept Sage 50 Add-On Tools range

Visit the Sage Marketplace